Beyond skill and time, one of the biggest factors that influence how and when we upgrade a home is budgeting for home improvement.

And those budgets have been severely affected by the COVID-19 pandemic. With rising house costs, there is a squeeze on the funds that might have been available to update a bathroom or build a garden room for work or hobbies. Just during the third quarter of 2021, household debt increased by 1.9 percent and totaled $15.24 trillion. Plus, home prices have been rising to the highest on record with nearly 20 percent year-over-year gains, and mortgages rose 2.2 percent to reach nearly $10.7 trillion.

Even for homeowners who haven’t overpaid for new housing during the past year, there’s a crunch on what we can get for our money. Some materials prices have climbed 400 percent or more since pre-pandemic levels. And there are supplies just won’t be available any time soon.

According to a recent survey from Angi, the top reasons why home improvement projects have not been completed are: pandemic disruptions (26 percent) and materials being too expensive (22 percent).

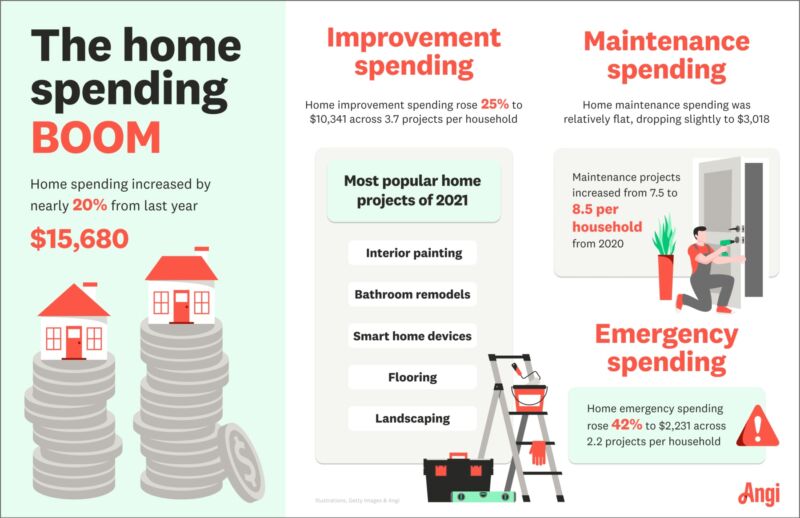

Still, with the rising costs of materials, home improvement spending rose 25 percent during 2021 to an average of $10,341 per household. The most popular projects of 2021 have been interior painting (32 percent), bathroom remodels (28 percent), and smart home device installations (27 percent).

How do we budget for home improvement?

It’s tough to budget for home improvement while there are supply chain issues and changing costs. It’s even tougher when you are new to home improvement.

Research project costs

If you’ve never embarked on a home improvement project, there is a lot to learn. From terminology to tools, the learning curve can be steep. However, when it comes to costs, there are helpful resources online like Home Advisor that share the average national costs and local costs for popular projects. Some projects include details of cost per square foot, making it possible for homeowners to apply the average costs to their situations.

Set an honest budget

More than anything, be honest about what funds are available when budgeting for home improvement projects. A budget is based on the amount of money you have to spend, not on how much it will cost. And the budget needs to cover the estimated costs (learn more about budgeting here) plus an additional 5 to 10 percent for surprises. In the world of home improvement, there are typically hidden issues or challenges that aren’t revealed until the drywall is removed.

And be honest with your partner about how much a project is expected to cost. And don’t keep secrets about how much you’ve already spent on the project. (Like that amazing faucet you spied on special and tucked away for later).

Decide on how the project will be funded

It would be nice if there was an endless supply of cash to pay for everything we want. However, we aren’t lucky enough to have that at our home. So after setting a budget, be realistic about where the money is going to come from.

A recent survey of homeowners found that 66 percent pay for home improvement projects with savings. About 30 percent use credit cards. Nearly half of credit card users expect to take 6 months or longer to pay for the projects charged.

Plus, there’s no need to risk financial disaster for the latest trends when the bathroom or kitchen function.

What tips do you have when it comes to budgeting for home improvement? Share in the comments below.